How to fix the form validation errors on my 1099/W2 forms?

If your 1099/W2 forms contain any errors based on the IRS Business rule, you should resolve the errors and then re-transmit your forms.

Note: Before you retransmit, you must upload the necessary supporting documents to prove the validity of the reported data.

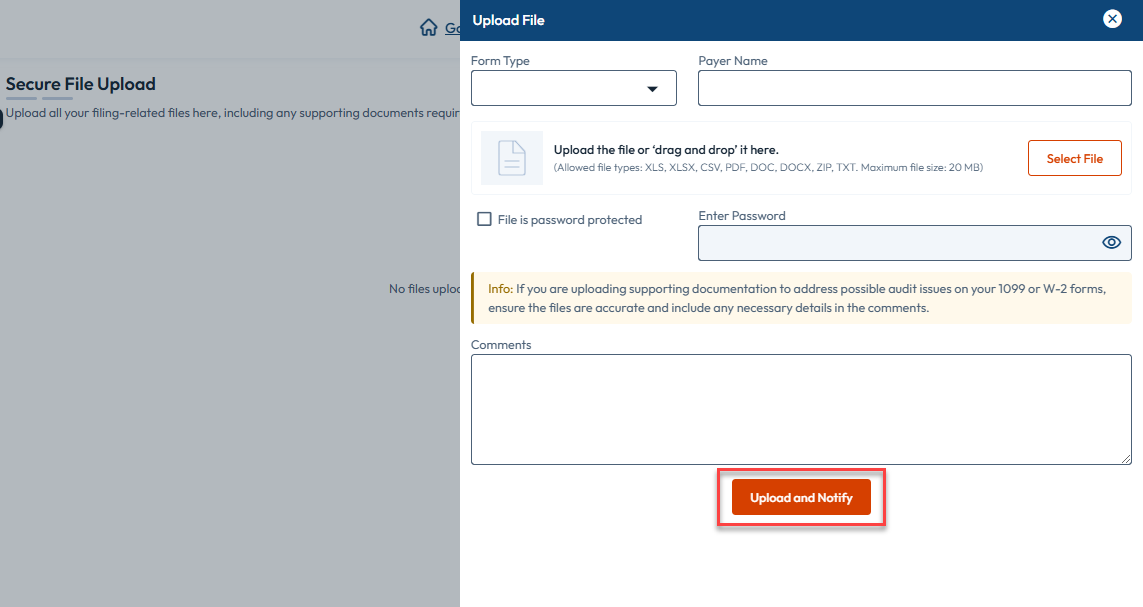

Follow the steps to upload your supporting documents:

Step 1: Navigate to the 9-dots menu and select the ‘Secure File Upload’ section.

Step 2: Upload all your filing-related supporting documents to address possible audit errors in 1099/W2 forms.

Step 3: Enter the required information, upload the necessary document, and add a comment regarding your issues. Ensure the details are correct and click the ‘Upload and Notify’ button.

Once you have uploaded the supporting documents, follow these steps to fix and retransmit your forms:

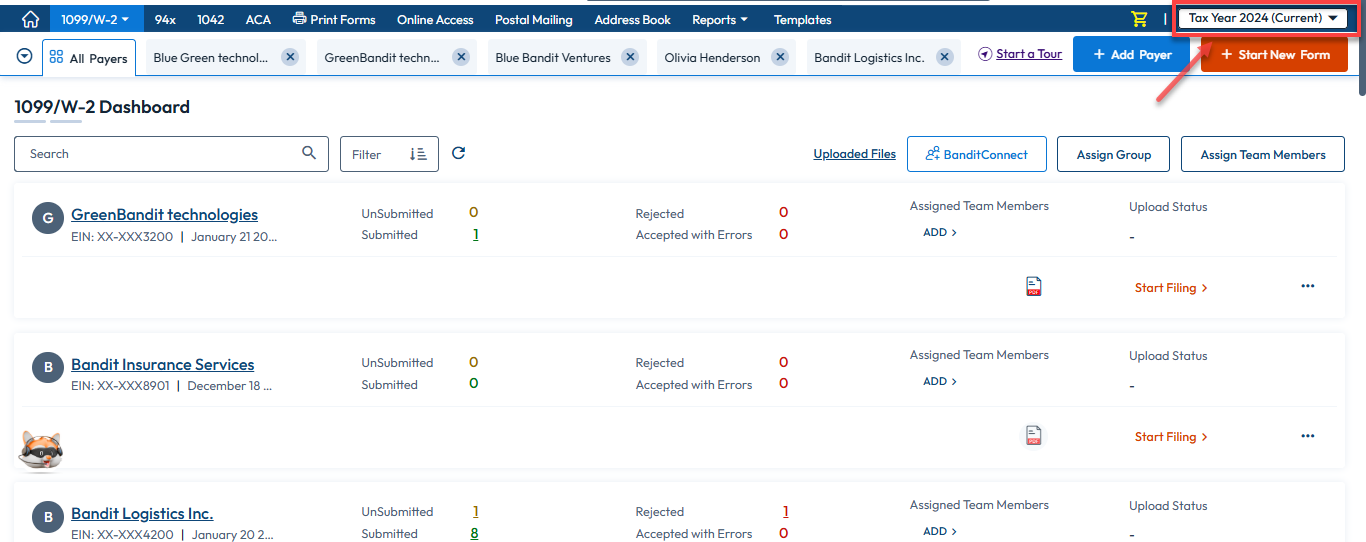

Step 1: Navigate to the 1099/W2 Dashboard.

Step 2: Select the payer and tax year

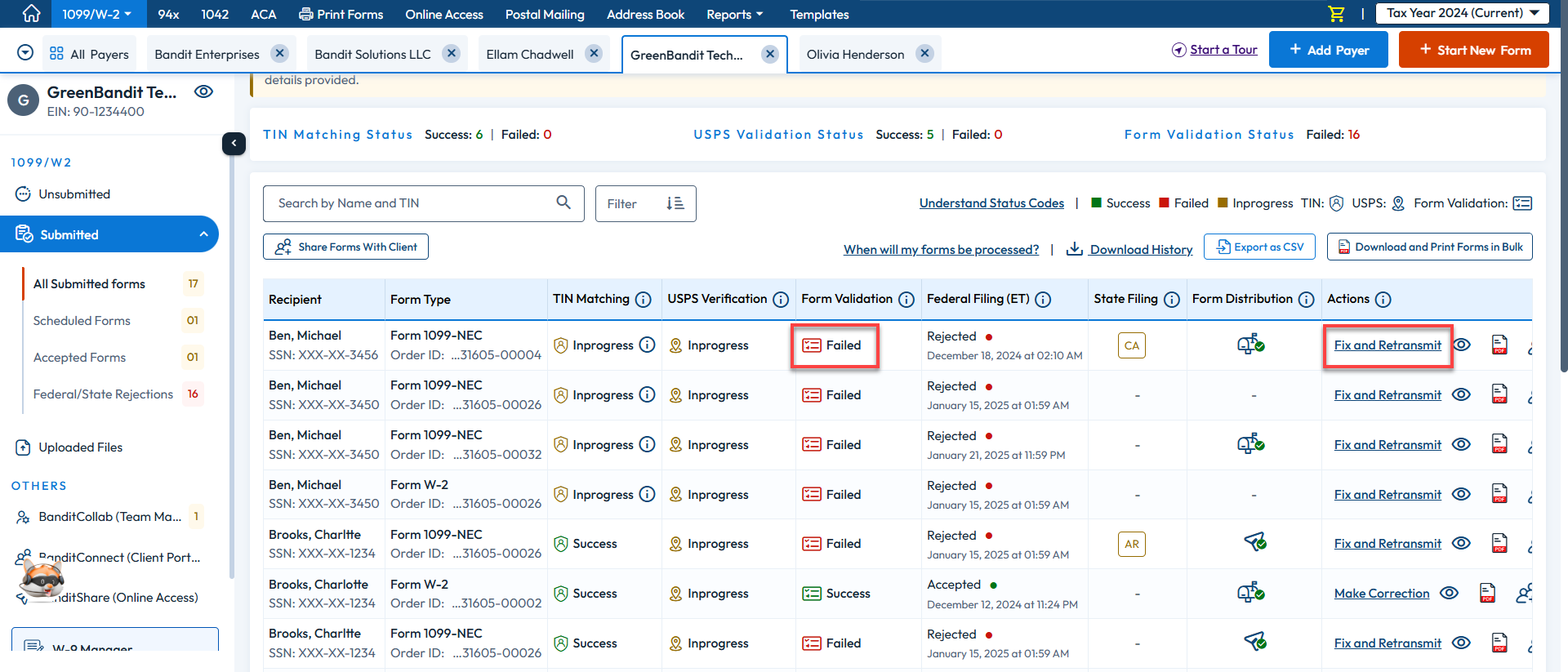

Step 3: On the submitted dashboard, click the ‘Fix and Retransmit’ button next to the payer whose form validation status has failed under the ‘Action Column’

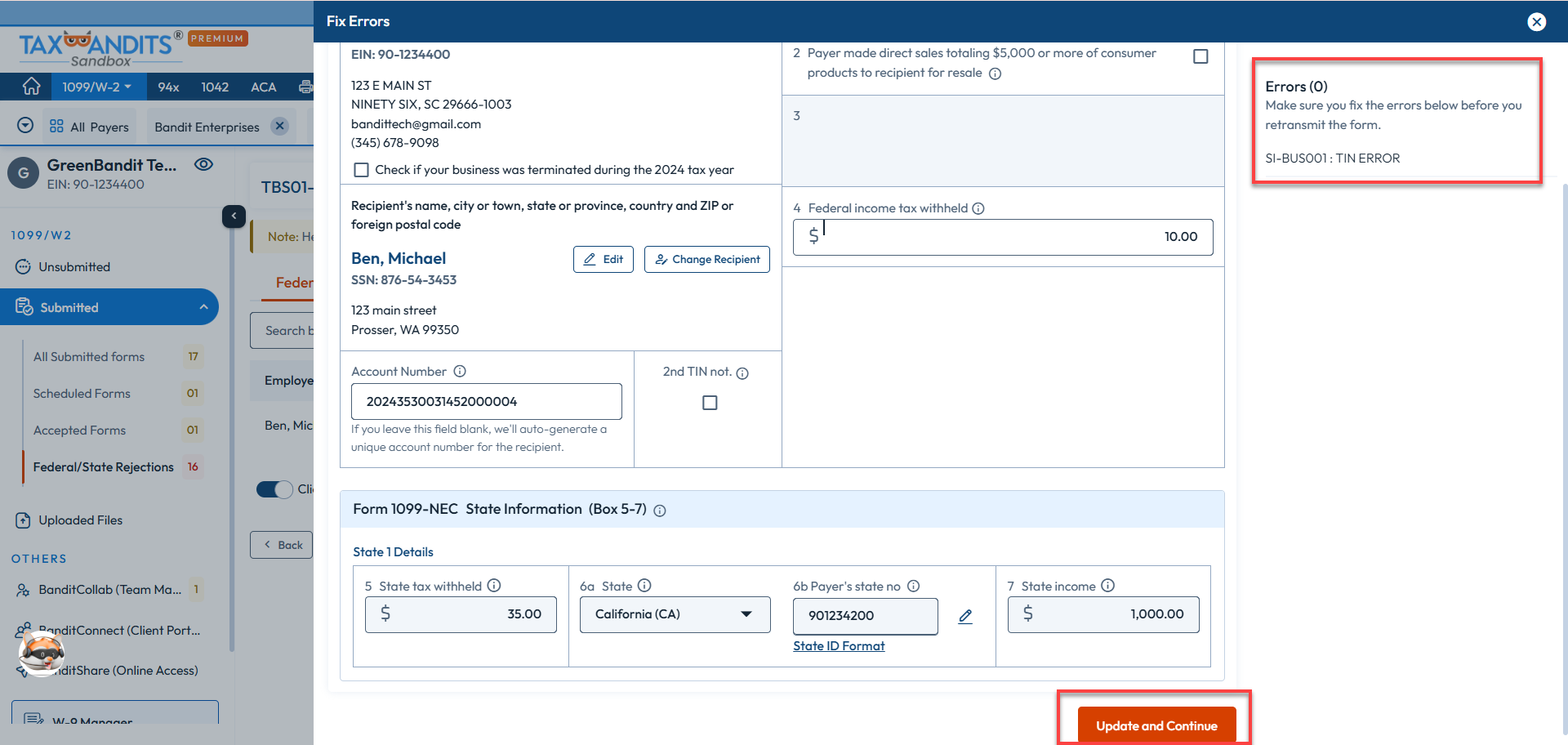

Step 4: Fix the errors on your forms, ensure everything is correct and accurate, and then click the ‘Update and Continue’ option.

Once you fixed the errors on your forms, you can continue with the filing process.

Need more help?

Get in touch with our dedicated support team Contact Us

Sign Up for a FREE TaxBandits Account!

The Smart CPA Choice

Already have an account? Sign in