TaxBandits Knowledge Base

Have questions? We've got you covered!How do I file form 940-PR?

Form 940-PR (FUTA) for Puerto Rico represents the Federal Unemployment Tax Act. For those workers who lose their jobs, the FUTA tax provides funds to provide unemployment benefits.

Follow the below steps to file form 940-PR:

- Sign in to your TaxBandits account.

- From the dashboard, click Start New >> Form >> 940-PR.

- Select your employer from the address book or enter the employer information.

- Select the Continue button under the tax year for which you need to file form 940-PR.

- Employer information will be pre-filled. Select the Type of Return in form 940-PR.

- If you had to pay state unemployment tax in one state only, Choose the state you are reporting.

FUTA details:

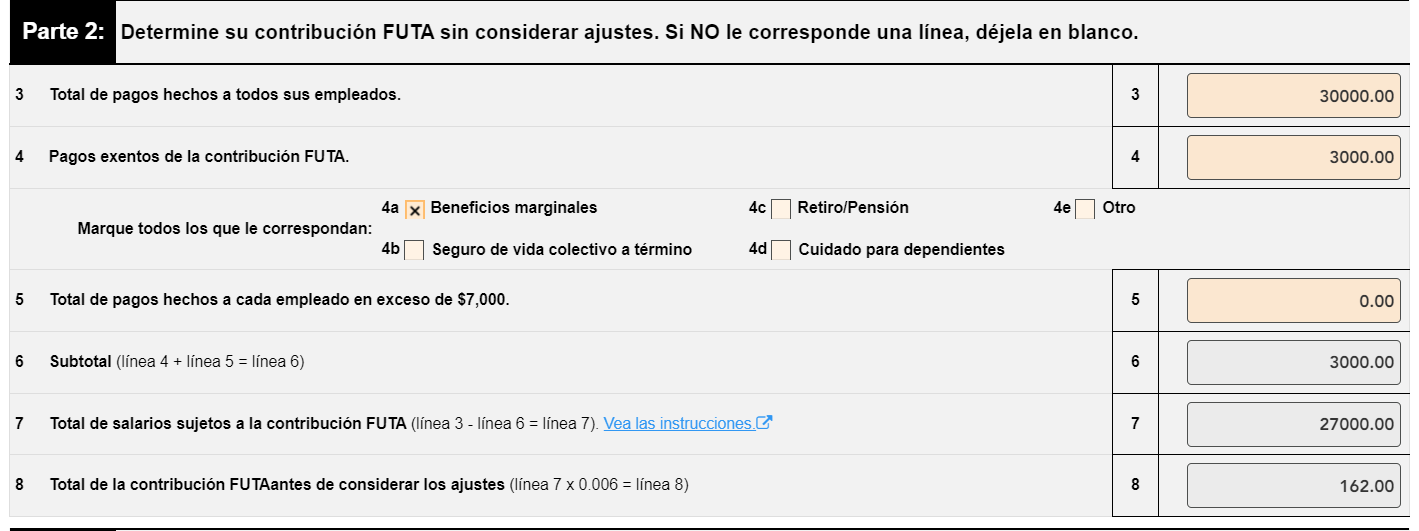

Report the total payments made during the calendar year. Include payments for the services of all employees, even if the payments aren't taxable for FUTA, and view the amount before adjustments.

Adjustments:

If some or all of your taxable FUTA wages you paid were excluded from state unemployment tax or any of your state unemployment tax payments were late, you can report them here.

- If you select “Yes”, enter the deposits made this year.

Balance Due/Overpayment:

Here, the deposits made for the reporting year will be shown.

- Enter the overpayment from the prior year. The Balance due / Overpayment is shown. Save & Continue to proceed further.

Payment Options:

Choose the payment options available to pay the IRS for 94x filing.

If you owe any tax to the IRS when filing 94x forms. In that case, you can opt for payments to the IRS through one of the following methods:

- Electronic Funds Withdrawal (EFW)

- Electronic Federal Tax Payment System (EFTPS)

- Credit/Debit Card

- Check or Money Order

Click here to learn more about the payment options available to you.

- Once you complete the form, a summary of the form information will be displayed. Click Next to proceed further.

If there is any error in the form, the error code and messages will be displayed on the Audit page. Click Fix Me to navigate to the form page to edit the information. Once you fix all the errors, click Next to navigate to the Signature page.

- Provide the taxpayer’s pin for form 8879-EMP and Save & Continue.

- There are a couple of options available to sign the form. You can click Send E-sign Request to send the email to request an e-sign from the taxpayer. In the By Other Menus tab, there is an option to download the 8879-EMP form and sign it to the taxpayer.

- Review the filing fee and select the add-on services such as text notification and printed copies of your 940-PR forms. Click Next.

- Review the form and click Complete Filing.

- Complete the payment, and your Form 940-PR will be transmitted to the IRS.

Need more help?

Get in touch with our dedicated support team Contact Us

Sign Up for a FREE TaxBandits Account!

The Smart CPA Choice

Already have an account? Sign in