TaxBandits Knowledge Base

Have questions? We've got you covered!

How does a tax professional send the Form 8453-EMP to the taxpayer for their signature?

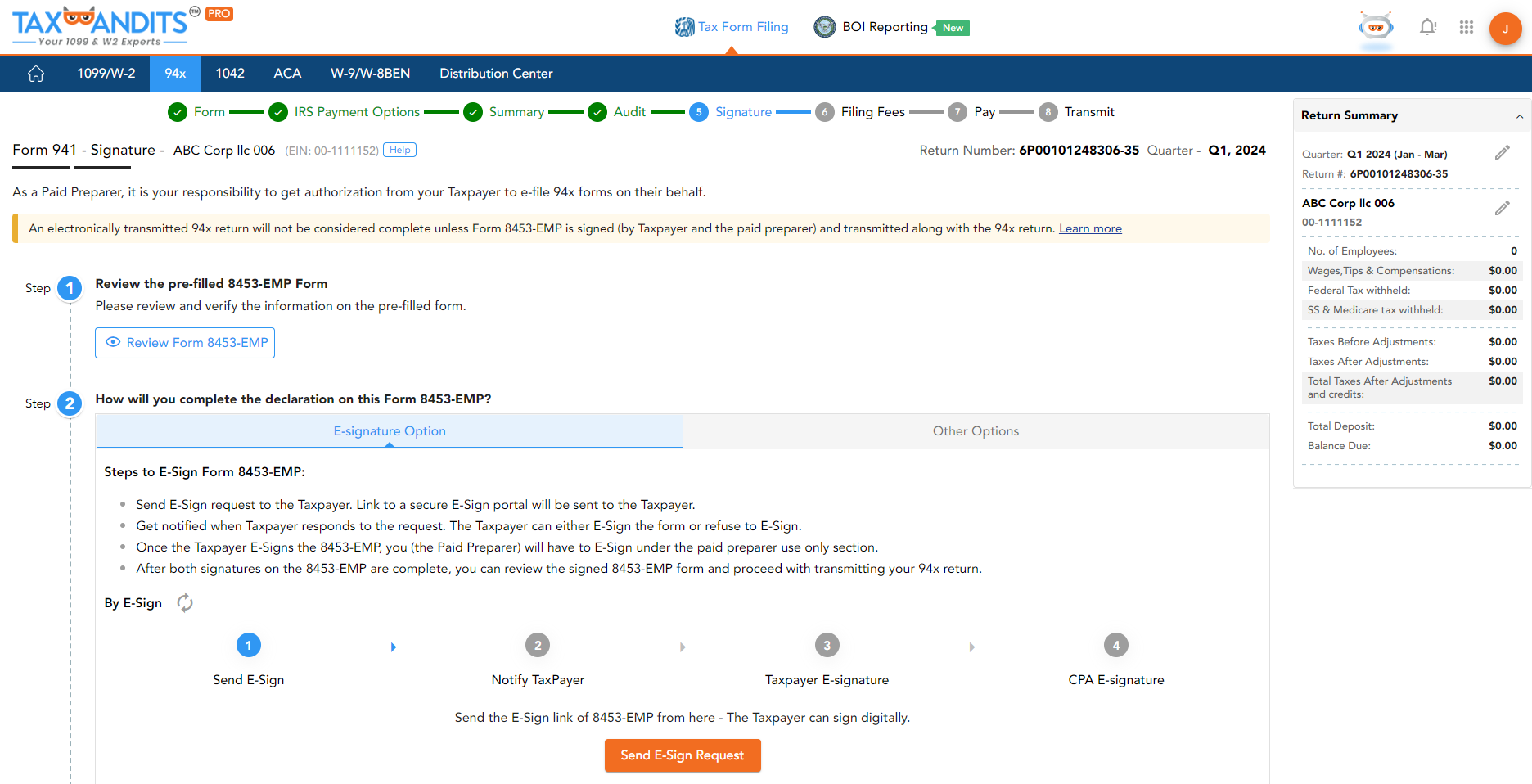

In the filing flow of 94x forms, in the Signature page, the tax professionals have two options on the Signature page to request authorization of Form 8453-EMP from the taxpayer, which include:

- E-sign Form 8453-EMP.

- Manually sign Form 8453-EMP.

E-sign Form 8453-EMP:

To e-sign Form 8453-EMP, the taxpayer can follow a simple process. The first process is to access a link, which will be emailed to them. Here are the following steps to E-sign Form 8453-EMP:

Step 1: Click “Send E-Sign Request” to notify the client regarding your E-Sign of Form 8453-EMP request.

Step 2: To request an E-signature from the client, enter the taxpayer's email and send a message requesting an E-Sign.

Step 3: Upon receiving your request, the client will be asked to provide their Employer Identification Number (EIN) and electronically sign Form 8453-EMP.

Step 4: After Clients complete the E-Signature process, Tax Professionals can sign on their behalf using “Click to Sign.” If necessary, click “Preview Form 8453” to review it.

Step 5: Form 8453-EMP has been successfully E-signed. Please click "Next" to proceed with your 941 filing and complete it.

Manually sign Form 8453-EMP: The taxpayer can download Form 8453-EMP, e-mail it to their client, and request an e-signature. Alternatively, they can fax Form 8453-EMP. Once the client signs Form 8453-EMP, the taxpayer can download and upload it.

When you electronically file 94x returns, the IRS also requires you to file Form 8453-EMP.

Need more help?

Get in touch with our dedicated support team Contact Us

Sign Up for a FREE TaxBandits Account!

The Smart CPA Choice

Already have an account? Sign in