How to apply for the Online Signature PIN in TaxBandits?

To apply for an online signature PIN, follow the steps below

Step 1: Sign in to the TaxBandits account.

Step 2: From the 94x dashboard, click ‘Start New Form’ and select ‘ 94x Online PIN Request.’

Step 3: Select the employer from the address book or add the employer details manually and click ‘Save and Continue.’

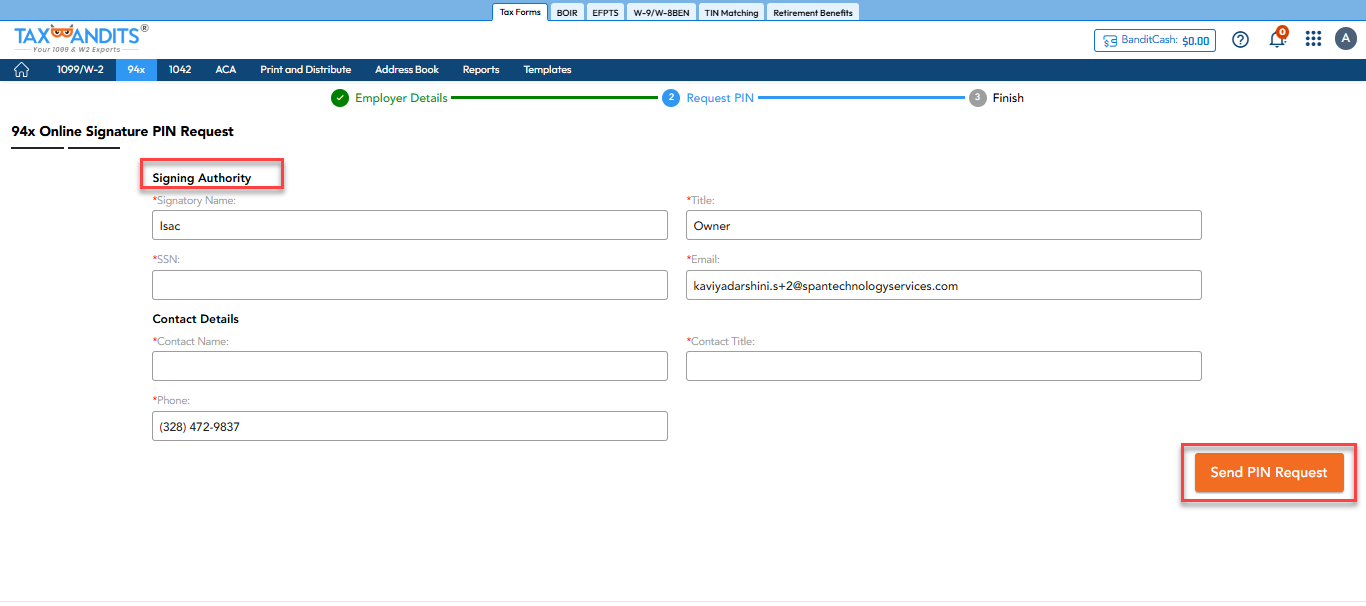

Step 4: Provide the information of the signing authority and click ‘Send PIN Request.’

Once submitted, you will receive your Online Signature PIN within 45 days after completing the PIN registration process.

Need more help?

Get in touch with our dedicated support team Contact Us

Sign Up for a FREE TaxBandits Account!

The Smart CPA Choice

Register Now

Already have an account? Sign in