How do I request a W-8BEN from my recipients?

Form W-8BEN - Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting must be submitted by a foreign individual who receives income from United States territory.

Follow the below steps to request W-8BEN from your recipient via TaxBandits:

- In the Dashboard, Start New >> Form >> W-8BEN.

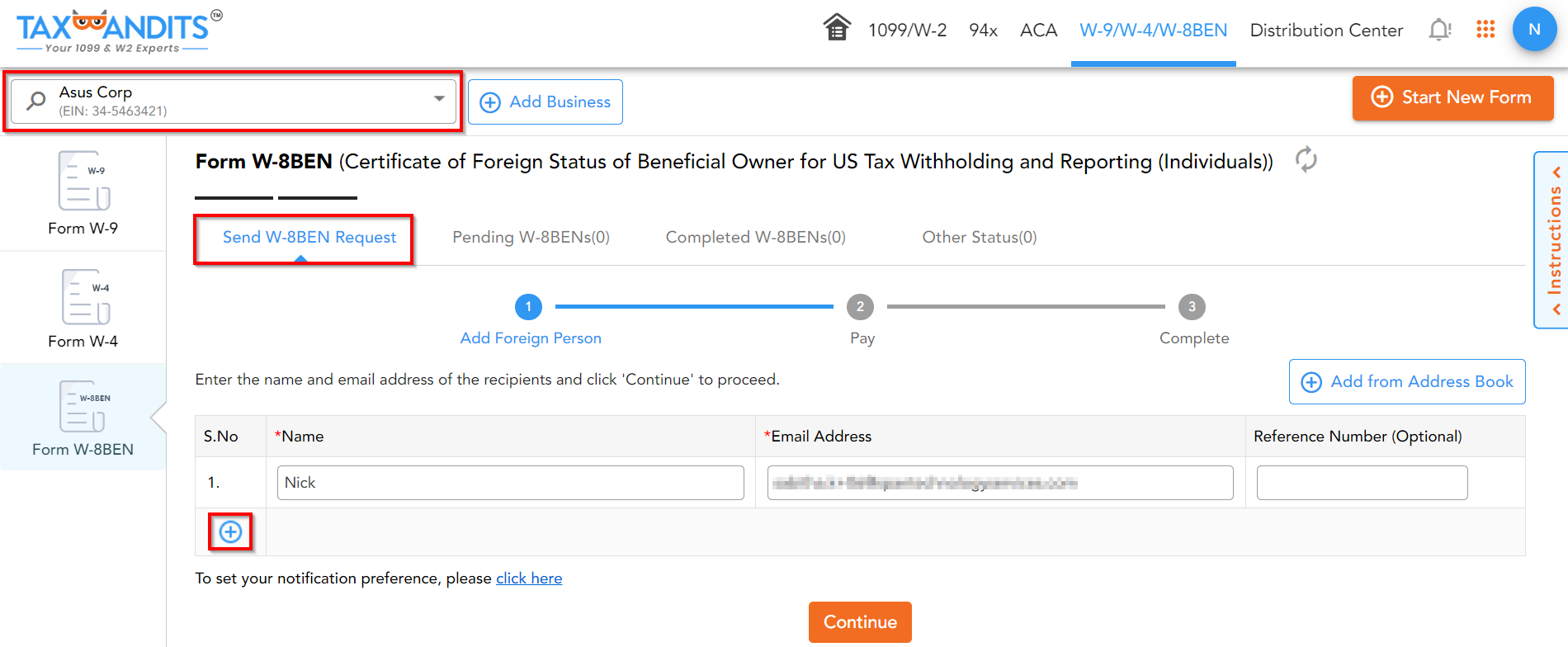

- To request W-8BEN for a particular recipient, select the Business Name or Add New Business. Then provide the recipient's Name and Email Address. If you want to add more recipients, click the + symbol and add another recipient. Click Continue to proceed further.

- Select the Payment options based on your preference, and the amount will be displayed. Click Send W-8BEN.

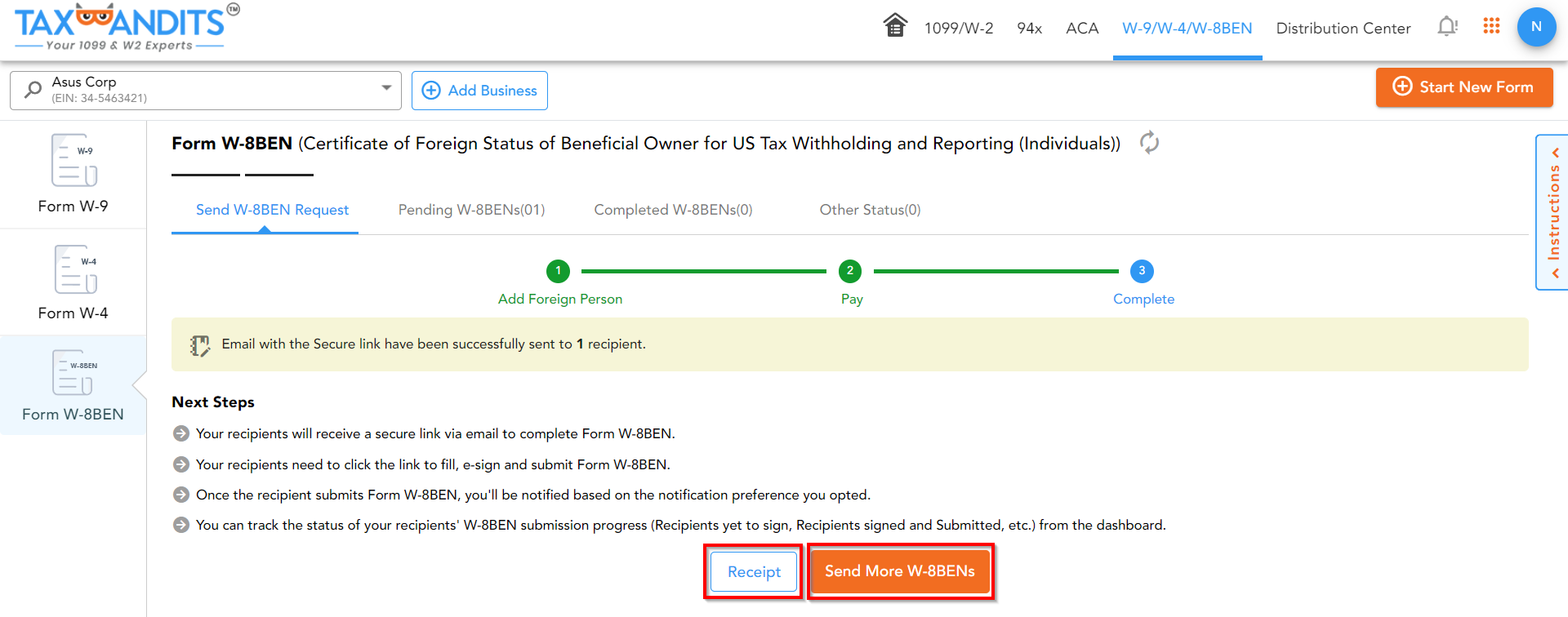

- Once payment is successful, recipients will receive an email with a link to the portal that allows them to complete their Form W-8BEN. From the below screen, you can also Send More W-8BENs and download the receipt.

Need more help?

Get in touch with our dedicated support team Contact Us

Sign Up for a FREE TaxBandits Account!

The Smart CPA Choice

Already have an account? Sign in